Steadiness

The Steadiness function helps you measure the steadiness of the states of columns with labels. Steadiness, in the context here, means having one label for at least a minimum number of candles. The more a label is seen consequtively, the more steady the column is. You can define arbitrary levels of steadiness using the Steadiness function. The inputs of this function are:

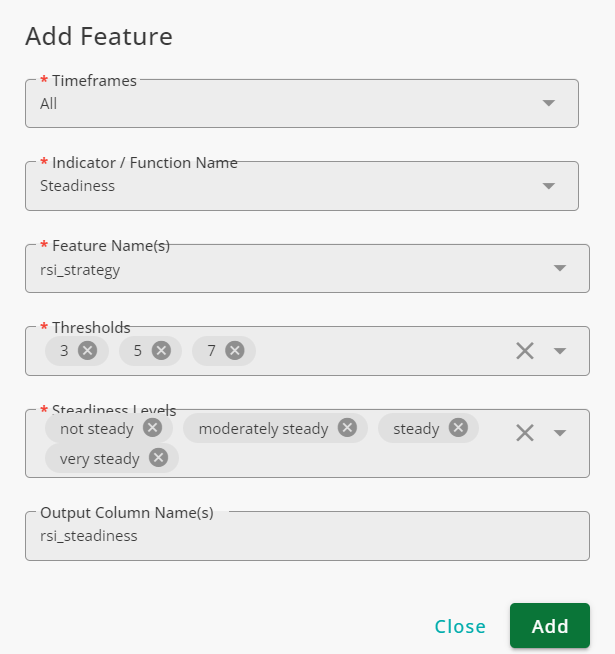

Timeframes: The timeframes in which the function is applied

Features Names: The column(s) that the function evaluates

Thresholds: The thresholds that separate different levels of steadiness from each other

Steadiness Levels: The names given to different levels of steadiness; note that you should enter the names in the reverse order of the thresholds.

Output Column Name(s): The name of the column in which the result will be stored

Example

The RSI is one of the popular technical indicators. The RSI ranges from zero to one hundred. When its value is less than 30, the RSI is oversold. When values are between 30 and 70, it is normal, and when RSI values exceed 70, the state of the RSI is overbought. We define four levels of steadiness: not steady, moderately steady, steady, very steady. When the state of RSI changes, it is not steady. If it keeps the new state for three candles, it is moderately steady. If it keeps the new state for five and seven candles, it is steady and very steady, respectively. To label the candles concerning the above mentioned, we use the Steadiness function as is shown in the fugure below:

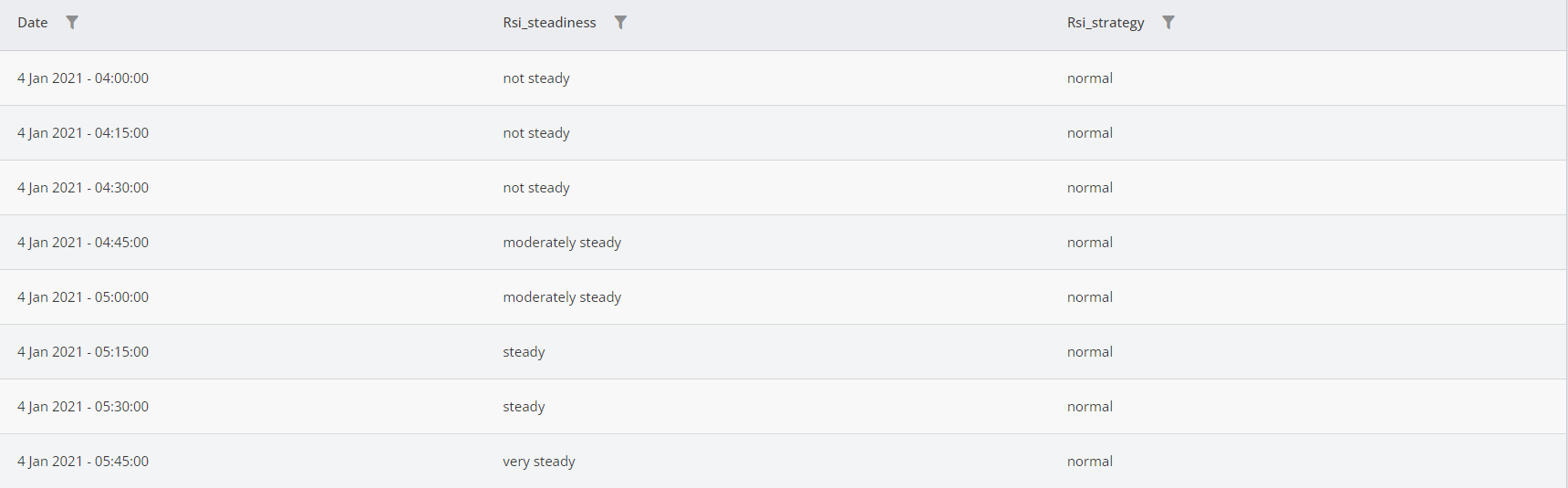

As is seen, the steadiness is not steady at the beginning of the table. After three candles, it becomes moderately steady, and as time passes, the state of the rsi_steadiness column becomes steady and very steady.