Crypto/Stocks Rules

Quotes Rule

You can run a backtest with multiple pairs if the second currency (quote) is the same among all pairs. For example, you cannot run a backtest with BTC/USDT, ETH/USDT, and ETH/BTC pairs because the quote in ETH/BTC is BTC, but the quote pair of the other two pairs is USDT.

Stocks/Crypto Metrics Unit

All numerical metrics using % as their unit use the quote to report backtests performance. For example, if the profit reported for ETH/BTC is 34%, then at the end of the backtest period, the strategy has 34% more BTC than it had at the beginning of the period.

Fee

The fee is set to 0.06%, but you need to check your broker or exchange and change it if they charge a different fee for trading. Note that the backtest results might considerably change if you use the wrong fee, especially when the number of trades during the backtest period is high.

Stocks/Crypto Position Management

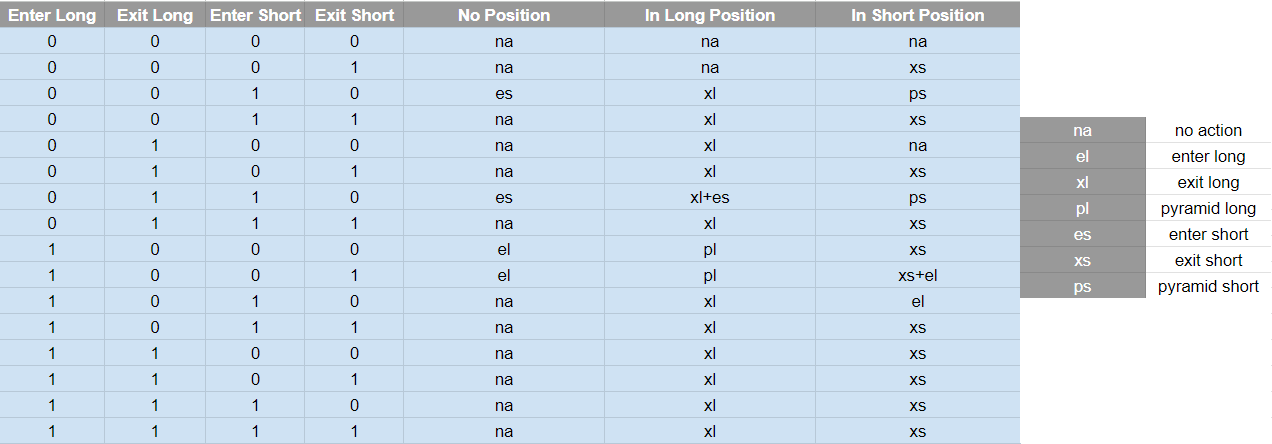

Our engine uses the table shown below to manage strategy positions in the backtest. For example, look at the third row from the top; this row occurs when your Enter Short signal is triggered. As another example, The last row occurs when Enter Long , Enter Short , Exit Long, and Exit Short signals are triggered simultaneously. For each row in the table, there are three scenarios, when the strategy has no position, when it is already in a long position, and when it is in a short position.

Use the legend on the right side to read the table. Note that the priority of actions in the legend is descending from top to button, meaning that no action's priority is highest, and enter long is the highest priority after it, and so on. For example, when your Enter Long and Exit Short signals are triggered simultaneously (the 10th row from above), if the strategy has no open position, a long position is opened. If the strategy has an open long position already, long pyramiding is executed, and if the strategy is in a short position, the short position is closed.

Stocks/Crypto Stop Loss and take Profit

Our system always considers worst-case scenarios. If a candle's low price triggers the stop loss and its close or high triggers the take profit in a long position, the system assumes that the price hits the candle's low before it hits the take profit. If a candle's low price triggers take profit in a short position and its high or close triggers the stop loss, the system assumes that the stop loss's condition is met before take profit's condition.

Forex Backtest

Forex Metrics Unit

All numerical metrics use the quote to report backtests performance. For example, if the profit reported for GBP/JPY is 3%, then at the end of the backtest period, the strategy has 3% more JPY than it had at the beginning of the period.

Commission

You need to set the trading commission with respect to the broker you are using and the market you are trading in. Three units are used to set the trading commission: Per Lot , Per Unit, and Percentage , depending on the market and the broker you are using to set the trading commission in the backtest.

Forex Stop Loss and take Profit

Our system always considers worst-case scenarios. If a candle's low price triggers the stop loss and its close or high triggers the take profit in a buy position, the system assumes that the price hits the candle's low before it hits the take profit. If a candle's low price triggers take profit in a sell position and its high or close triggers the stop loss, the system assumes that the stop loss's condition is met before take profit's condition.

Equity Risk

Just like stop loss and take profit, if any of the high, low, open, and close prices trigger the equity risk, the system assumes that the triggering price comes before the others, leading to equity risk to close trades.

Pair Settings

Each pair has its digits, contract size, and spread. Digits and contract size are consistent among the brokers, but the spread might change from one broker to another. Always ensure that the spread value used in the backtest matches the spread in your broker.

Forex Position Management

Buy and sell positions are handled independently in Forex backtest engine, enabling you to have open buy and sell positions simultaneously.

Data Range

When you are creating your market data, you have two options: QuantiX Data Provider and Meta API. If you use QuantiX Data Provider, you can access all currency pairs data from 2008 up to the present day. If you need other pairs like metals, CFDs, Cryptocurrencies, etc., you should use Meta API. Note that when Meta Data is used, the time range of the data is limited to the last two years.