Tutorial 1: How to Use Marketplace for Copy Trading

The Marketplace is where you can discover a wide range of trading bots, review their backtest and live performance, and subscribe to them to generate passive income. For professional traders, the Marketplace serves as a platform to showcase their strategies and offer them to members of the QuantiX community.

This tutorial will guide you through the process of finding the right strategy that aligns with your goals and connecting it to your trading account.

To use the Marketplace, follow these four steps:

Connect your exchange account to the QuantiX platform.

Explore the Marketplace to find trading bots that meet your criteria.

Review the details of the trading bots you identified in the previous step.

Subscribe to your chosen trading bot and complete the subscription payment.

1. Connecting QuantiX to Crypto Exchanges

To apply the trades a bot makes to your funds, you don't have to deposit your money into our platform. Instead, you give us permission to open and close trades in your trading account using your exchange's API.

At this time, our platform supports the following exchanges:

Binance

BingX

Bybit

Coinex

Gate.io

HTX

Kucoin

MEXC

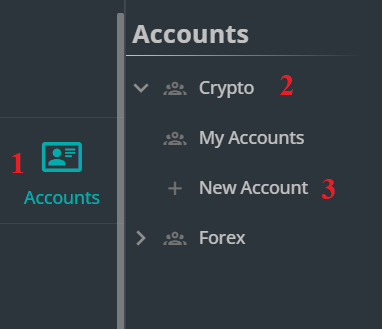

To connect your account to the QuantiX platform, select Accounts from the left sidebar, open Crypto, and click New Account.

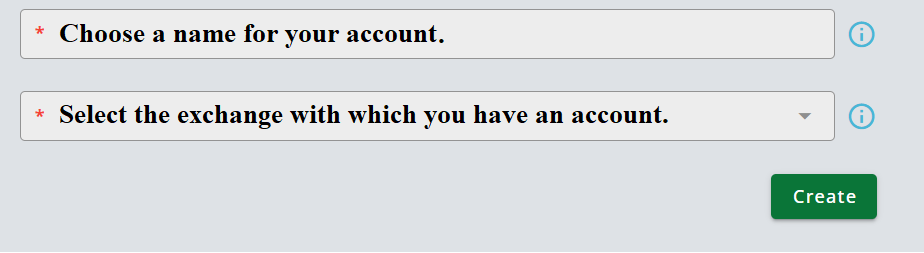

On the New Account page, you can connect your trading account to our platform. To do so, follow the steps below:

Choose a name for the account you want to connect to QuantiX.

Select the exchange where your account is held.

To connect your account to QuantiX, you'll need to provide your API key and API secret. To learn how to obtain your API credentials, visit the links below.

2. Finding the Right Trading Bot

Finding the right trading bot is the most important part of copy trading. After all, you're going to trust a bot with your money, so you should take as much time as you need to find a trading bot that matches your expectations.

The Marketplace is where you can find a variety of trading bots, each with its own unique profitability and risk profile. While one bot may match an aggressive trader's expectations, it may seem too risky to a risk-averse person. Because people have different risk tolerances and financial goals, there's no one-size-fits-all trading bot. Instead, each individual should take the time to find the strategy that best suits them.

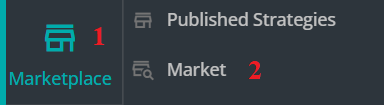

To find an appropriate trading bot, login to your QuantiX account and from the left sidebar, select Marketplace and click on Market.

You can find various trading bots here that are either developed by our team or the QuantiX community. The details of these trading bots are shown using Trade Flashes

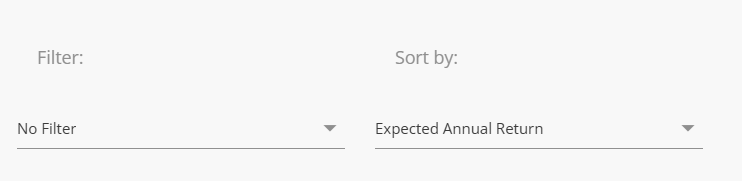

The Market gives you multiple filters to categorize and sort trading bots all of which are available in the Market Bar shown below.

Before doing anything, click the Refresh button in the Market Bar to update your Marketplace with the latest state of the bots. After that, select one of the markets (Crypto, Equity, or Forex) from the left side of the Market Bar to view the bots related to that market.

If you already know which bot you want to subscribe to, type its full name or part of it, and press Enter on your keyboard.

If you are exploring the Marketplace to see available options, you can use the Filter button to apply various filters and sort bots.

Some of the filters available are:

Single Asset: Only shows trading bots that trade a single pair.

Portfolio Bots: Only shows trading bots that trade multiple pairs.

Free Bots: Only shows trading bots that are free to subscribe to.

The sorting options are:

Creation Date: Sorts trading bots by their time of creation.

Bot Return: Sorts trading bots by their generated return during the backtest period.

Expected Annual Return: Sorts trading bots by their expected annual return, which is the return expected from the bot after a 365-day investment period based on backtest results.

Worst Expected Annual Return: Sorts trading bots by the worst expected drop in the portfolio's value, measured as a percentage of the strategy's initial capital during the backtest period.

You can use Sort Button in the Market Bar to reverse sorting order.

Once you come up with the right filtering and sorting options, you should use Trade Flashes to learn about trading bots' features. Below are a few recommendations for using Trade Flashes efficiently:

Always check what pair(s) the bot trades and whether you trust them.

If you are not eligible for futures trading, ensure that the trading bot operates in the Spot market.

Look at the live portfolio graph and see if it meets your expectations.

Check the backtesting period shown on a Trade Flash and make sure it is long enough (at least 2 years).

Both backtest and live trading results are reported on Trade Flashes. Ensure that live trading results align with backtest results. Remember, the longer the live trading period, the more reliable its results.

More subscribers mean more people have trusted the bot.

Although you can filter and sort bots in any manner, we suggest that if you are a risk-averse investor, you select Worst Expected Drawdown from the sorting options and sort the bots in ascending order. This way, you will see trading bots with the lowest risks first. If you are an aggressive investor, sort the trading bots by Bot Return or Expected Annual Return and see which bot satisfies you the most.

After spotting the suitable bot(s) using the information on the Trade Flashes, you should investigate more using More Details and Live Status pages.

3. Reviewing Bots Details

More Details and Live Status pages provide you with details of a bot's backtesting and live trading performance. To access backtest reports, subscriber comments, developer explanations, and many other options — including a share button and support — use More Details.

If you want to investigate a bot's live trading performance in detail, use Live Status.

To learn more about the metrics reported in the reports and how to interpret them, we suggest reading the articles below.

Calmar Ratio: Considering the Returns and Downside Risk Simultaneously

Measuring Stability: A Key to Identifying Reliable Strategies

Once you find the trading bot that meets your expectations, you can subscribe to it and connect it to your trading account.