Market

You can explore a variety of trading bots developed by the QuantiX team and our customers in the Market. The Market is divided into three sections: Cryptocurrency, Equity, and Forex. In each section, you can find related strategies for each market. Each bot comes with a unique profitability and risk profile, allowing you to choose the one that best aligns with your expectations.

Crypto trading bots can be used with any crypto exchange, while Forex trading bots are compatible with any broker that supports MT4 or MT5. To use these bots for copy trading, you must first add your trading account credentials in the Accounts section. If you're unsure how to do this, please refer to 'What is Accounts'.

The subscription fee is paid monthly.

You can run as many trading bots as you like, but each bot can be connected to only one account. This means that if you want to run a strategy on two different trading accounts, you will need to purchase two subscriptions.

Before subscribing to a trading bot, make sure to read all the details of its backtest report and live trading performance report to ensure the strategy matches your expectations and risk appetite.

Some of our trading bots require futures trading access, which you may not be eligible for depending on the policies of your exchange or broker. Before subscribing to such strategies, ensure that you are eligible for futures trading.

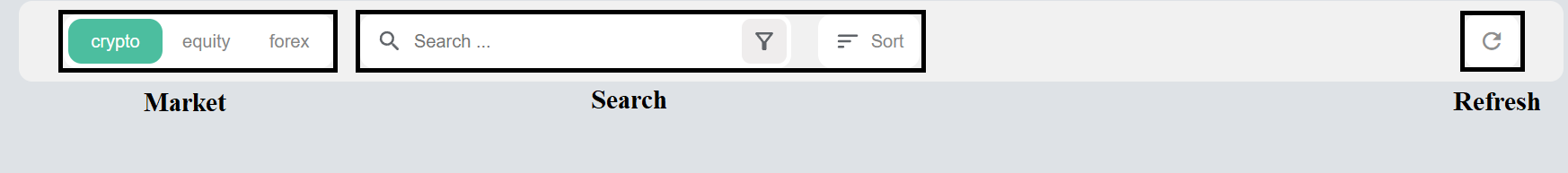

Market Bar

The Market Bar is shown on top of the Market and helps you find trading bots that match your expectations. Sections of the Market Bar is explained below.

Parameter | Description |

|---|---|

Market | Switch between different markets to find trading bots for each market. |

Search | Helps you find trading bots in the marketplace. Use the Search Bar to find bots by name. The Filter button allows you to apply filters and sort bots based on return, expected drawdown, etc. The Sort button changes the sorting order. |

Refresh | Use this button to update your marketplace data with the most recent state of the trading bots. |

TradeFlash

TradeFlashes display key information about trading bots in the marketplace. Each TradeFlash is designed to provide a clear and comprehensive snapshot of a bot's performance at a glance. The table below outlines the information and actions available within a TradeFlash.

Field/Button | Description |

|---|---|

Mode | Indicates whether the strategy trades a single pair or a portfolio of pairs. Portfolio bots have a green background, while single-pair bots have a blue background for better distinction. |

Copy on Exchange | When available, this button redirects you to a crypto exchange, allowing you to copy the bot directly without using your QuantiX account. |

Telegram Button | Use this button and follow the instructions to access the Telegram bots associated with trading bots. These Telegram bots allow you to track trading bot performance via Telegram. |

Exchange | Displays the exchange where the bot owner has implemented the trading bot. If supported, you can copy the bot directly from the exchange without involving QuantiX. |

Rating | The score assigned to the trading bot by its users. |

Name | The name given to the trading bot. |

Subscription Fee | The monthly fee required to subscribe to the bot. If you use "Copy on Exchange," no subscription fee is charged. |

Developer's Account | The name of the trading bot's developer. |

Creation Date | The date the trading bot was listed in the marketplace. |

Subscribers | The number of QuantiX users subscribed to the bot. This does not include copiers on exchanges. |

Timeframe | The timeframe the bot uses for trading; bots with lower timeframes typically trade more frequently. |

Market Type | Indicates whether the trading bot operates in the Spot or Futures market. Before subscribing to a Futures bot, ensure your trading account is eligible for futures trading. |

List of Portfolio Pairs | The trading pairs included in the bot's portfolio. |

Balance Trend | Displays the bot’s balance trend in live trading. |

Backtest Period | The time range during which the strategy was tested in a backtest. |

Bot Return | The strategy's return during both backtesting and live trading. |

Expected Annual Return | The estimated annual return based on backtest and live trading performance. Live trading Expected Annual Return may vary, while backtest Expected Annual Return remains fixed. |

Worst Expected Drawdown | The worst expected decline in portfolio value, measured as a percentage of the initial capital. Live trading Worst Expected Drawdown may vary, but backtest Worst Expected Drawdown remains fixed. |

Live Status | Click this button to access a full report on live trading performance. |

More Details | Click this button for detailed reports, developer explanations, user comments, and additional insights. |