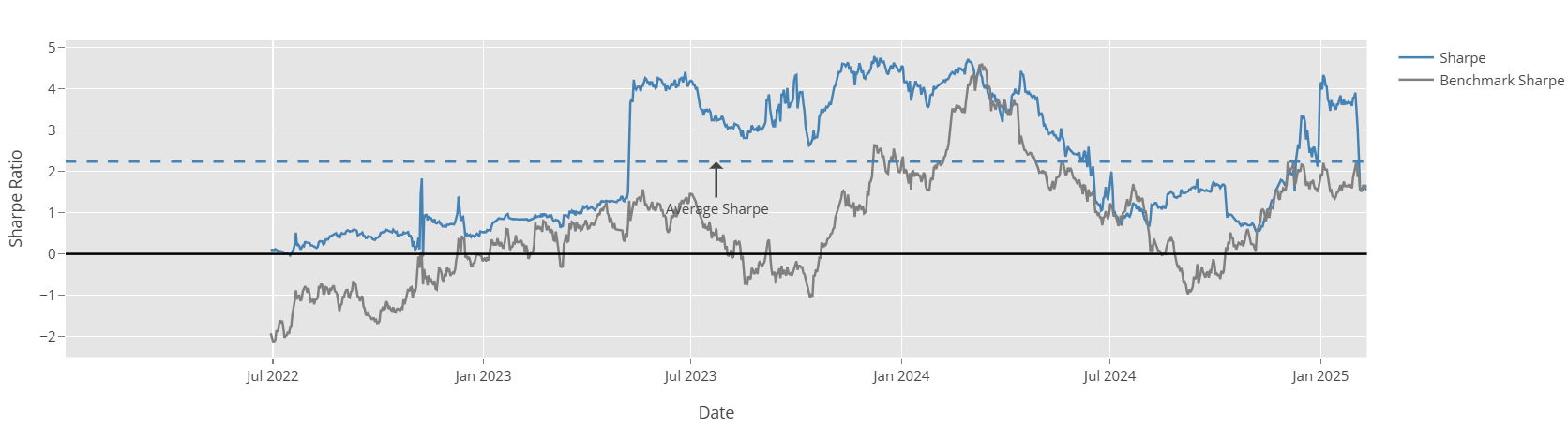

Rolling Sharpe Ratio

The Rolling Sharpe Ratio measures the Sharpe ratio of the strategy's holdings over a six-month period, calculated for each data point using the daily returns of the past six months. To learn more about Sharpe ratio, read here

Since there isn't enough data for calculation, the Rolling Sharpe Ratio is unavailable for the first six months of the backtest. Additionally, the chart displays both the overall Sharpe ratio of the strategy (dashed line) and the buy and hold’s Sharpe ratio (grey line).

A strategy is considered more stable when the Rolling Sharpe ratio closely follows the average Sharpe ratio. As long as the rolling Sharpe ratio remains positive (preferably above 1), the risks taken by the strategy are justified by the returns. A strong strategy maintains a rolling Sharpe ratio higher than the buy and hold’s, indicating a better reward-to-risk ratio compared to simple holding.

Key Considerations:

The average Sharpe ratio should be positive. For an ideal strategy, it should exceed 1, with higher values indicating better performance.

The closer the rolling Sharpe ratio stays to the average Sharpe ratio, the more consistent and stable the strategy is.

The higher the rolling Sharpe ratio compared to the buy and hold’s, the better the strategy's risk-adjusted returns relative to buy and hold.