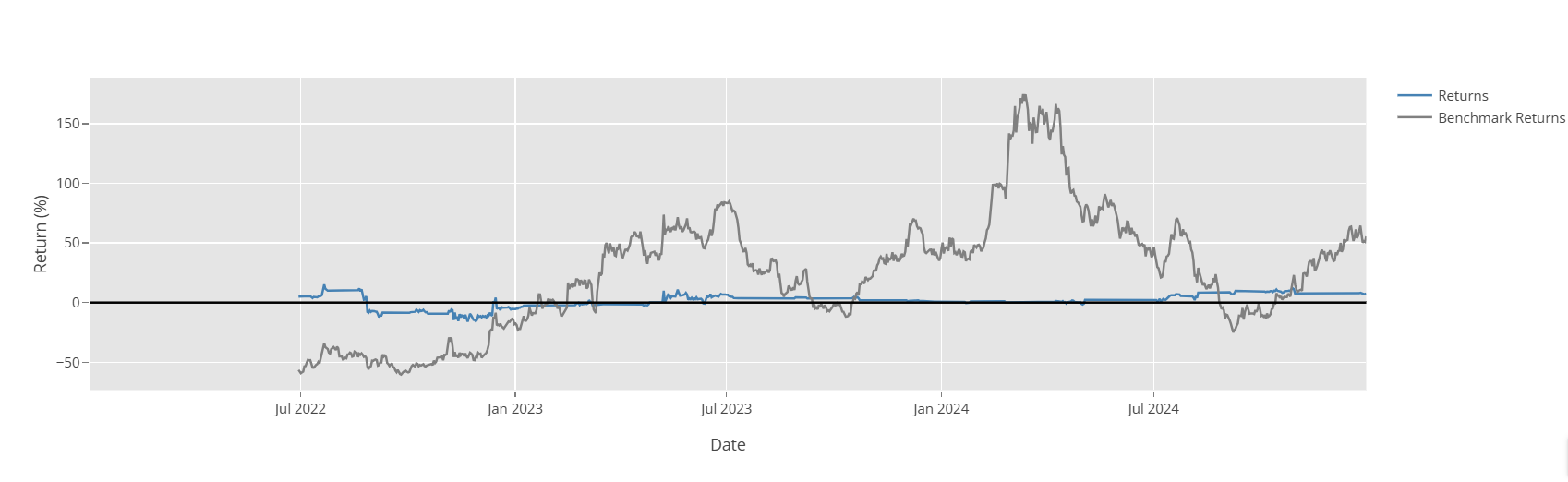

Rolling Return

The Rolling Return represents the strategy's return over a six-month period, calculated for each data point using the daily returns of the past six months. This return is expressed as a percentage of the strategy's total fund (blue line). The report also includes the rolling return of the holding strategy (grey line).

Since there isn't enough data for calculation, the rolling return is unavailable for the first six months of the backtest. Strategies that show negative rolling returns for extended periods should be approached with caution, as there is a significant risk that the strategy may remain unprofitable for a long time.

Key Considerations:

While the rolling return of the buy and hold strategy may fluctuate significantly over time, reliable strategies tend to maintain a stable rolling return throughout the backtest period.

Strategies experiencing prolonged periods of negative rolling returns have a high likelihood of generating sustained negative returns in the future.