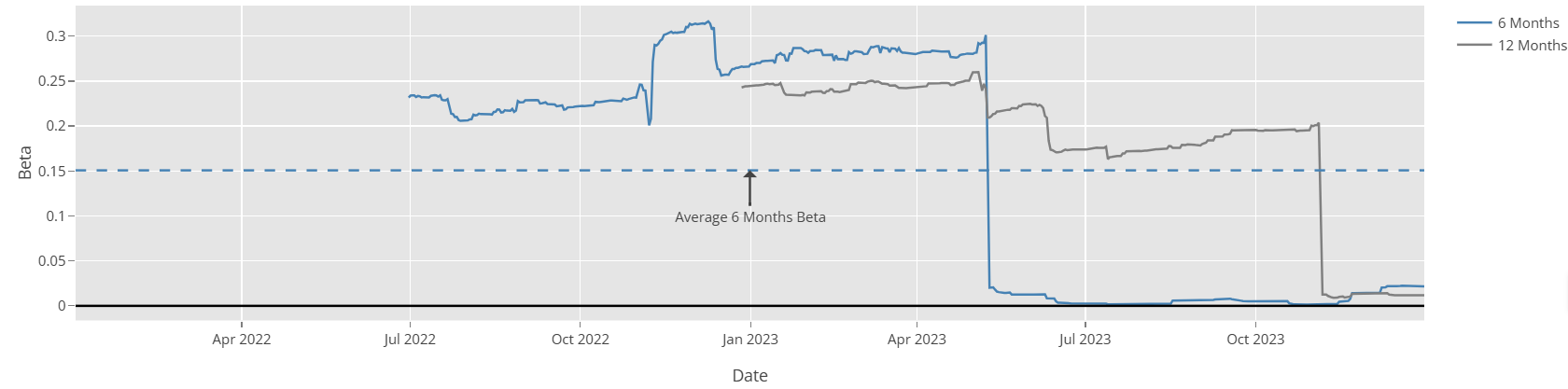

Rolling Beta

In trading and investing, beta (β) is a measure of an asset's volatility compared to the overall market. It indicates how much an asset's price tends to move in relation to a benchmark, which is the market change of assets in the strategy's portfolio in our case. You can also see the average Beta value of the strategy during the backtest period. To learn more about Beta, read here .The Rolling Beta measures the Beta of the strategy's holdings over a six-month and one-year periods, calculated for each data point using the daily returns of the past six and twelve months, respectively.

Key Considerations:

Beta = 1: The strategy moves in line with the market. If the market rises 5%, the strategy is expected to rise 5%.

Beta > 1: The strategy is more volatile than the market. A beta of 1.5 means the strategy moves 1.5 times the market's movement (e.g., if the market rises 5%, the strategy may rise 7.5%).

Beta < 1: The strategy is less volatile than the market. A beta of 0.5 means the strategy moves only half as much as the market (e.g., if the market rises 5%, the asset may rise 2.5%).

Beta < 0: A negative beta means the strategy moves in the opposite direction of the market.

High-beta strategies offer higher potential returns but carry more risk.

Low-beta strategies provide stability and lower risk.