Signal Analysis

Signal Analysis is a comprehensive tool designed to evaluate signal performance. It uses targets as the foundation for analysis, comparing the signal's behavior to that of the selected target. Different types of analysis are available based on the target type, with distinct methods for numerical and categorical targets. To use this tool, the following fields must be filled in.

Field | Description |

|---|---|

Signal | The signal you want to analyze. |

Market Data | Any market data in which the signal is defined. |

Pair(s) | The pair(s) used in the analysis. |

Timeframe | The timeframe from which the analysis data comes. |

Start Date | The first day of the time period used in the analysis. |

End Date | The last day of the time period used in the analysis. |

Report | The type of analysis; different reports provide different insights. |

Target | The target used as the base of analysis; the targets shown depend on the type of analysis selected in Report. |

Report for each asset separately | Turn this button ON to view the performance of the signal for each pair separately. |

Below is an explanation of each report.

Categorical Target Analysis

Categorical target Analysis (CTA) evaluates a signal with a categorical target. Categorical targets attach labels to candles. These labels are usually buy, sell, and no-action. Categorical targets include but are not limited to Rally-Based Classifying, Reward/Risk-Based Classifying, and Positive Momentum Classifying. To use this tool, select Categorical Target Analysis from the Report and select the target you want to use as the reference of your analysis. You can use the targets added to your data previously or add a target inline. Finally, click Get Report and wait for the system to prepare the results.

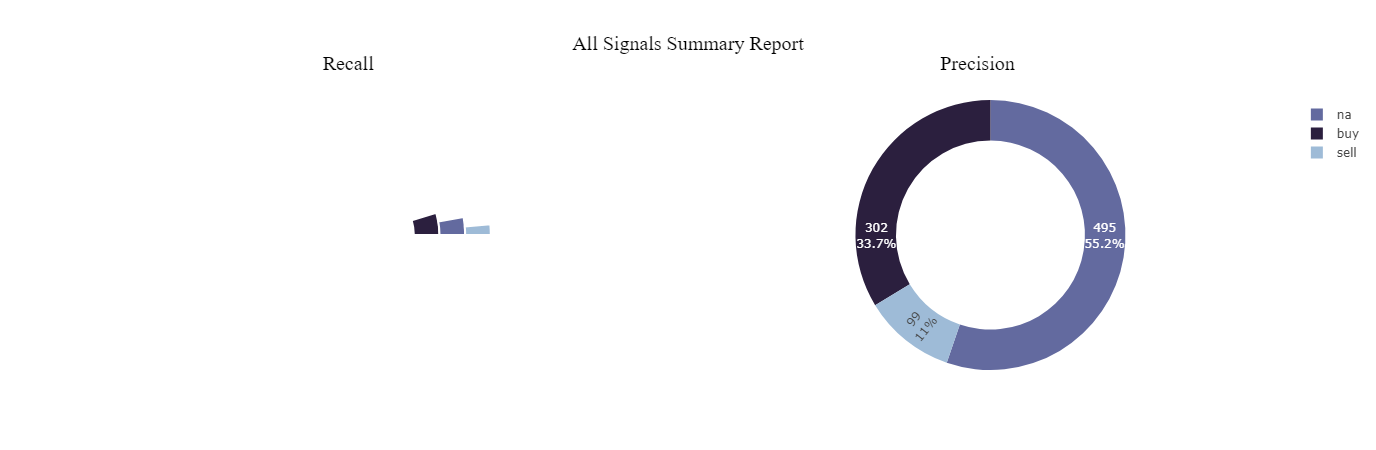

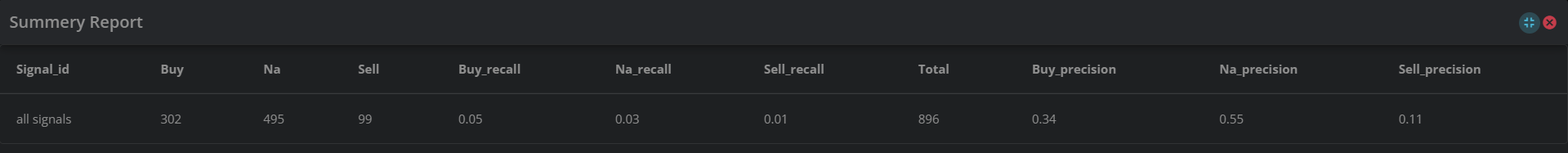

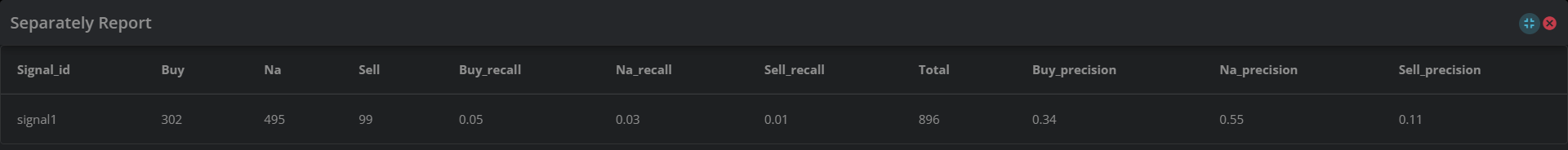

Precision Recall Summary

This chart illustrates precision and recall for the classes of the target. Using this report, you will know the precision and recall of the signals if employed for each class.

Summary

The Summary table reports the precision and recall of the signal for each class. As a matter of fact, this table reports the corresponding values in the charts of Precision Recall Summary. It also shows how many times the signal was triggered for each class.

Decomposition Analysis

If a signal is composed of a number of sub-signals, the Decomposition Analysis decomposes the signal into its sub-signals and provides the information of the Summary report for each sub-signal separately.

Numerical Target Analysis

Numerical target Analysis (NTA) evaluates your signal with a numeric target. A numeric target is a target that has values (and not labels). Any numeric target in QuantiX, including Rally-based Rating, Positive Momentum, etc. is compatible with NTA. To use NTA, select Numerical Target Analysis from the Report and select the target you want to use as the reference of your analysis. You can use the targets added to your data previously or add a target inline. Finally, click on Get Report and wait for the system to prepare the results.

Signal Distribution

The signal distribution graph shows the distribution of the signal over values of the selected target. In other words, it shows how many times the signal was triggered for different ranges of the target. The figure below shows Signal Distribution graph. The X-axis shows the ranges of target and the Y-axis is the number of signal occurrences for each range. We used Rally-Based Rating with window size of 100 for Apple and Microsoft. The report time range is 2021/01/01 to 202/01/01 and the timeframe is 15-minute.

.png)

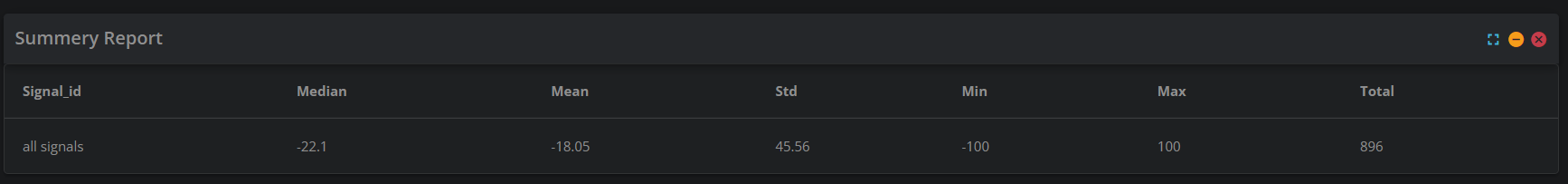

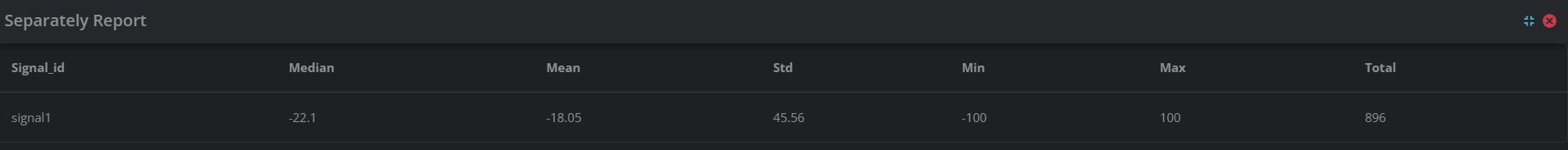

Summary

This table reports the statistics of the distribution shown in the Signal Distribution graph. In this table, the mean, median, std, minimum, and maximum of the distribution of the signals over the selected target are reported. the Summary table for the distribution above is shown below.

Decomposition Analysis

If a signal is composed of a number of sub-signals, the Decomposition Analysis decomposes the signal into its sub-signals and provides the information of the Summary report for each sub-signal separately.

Rally Based Analysis

This analysis tries to integrate the concept of rallies with precision and recall. It first finds rallies using a window and then measures statistics of a categorical target for these rallies. This analysis might look like the categorical target analysis at first, but they are different. In categorical target analysis, we count the number of signal occurrences for each label, and thus, you may count the occurrence of a signal for a label many times. In rally-based analysis though, a signal is counted only once for a rally, even if it is fired many times in the rally. The tables and reports of this analysis are the same as that of the categorical target analysis. You also need to set a window size to find rallies. Note that the size of the window used to find rallies is independent of the target settings used for analysis.

Stop Loss Take Profit Optimizer

This tool is meant to help you with selecting stop loss and take profit for a signal. The metric used here for evaluation is the profit made by the strategy with different stop loss and take profits used. The following configurations must be set:

Forward-Looking Window Length: Stop Take Optimizer uses the data of the future to evaluate how stop loss and take profit orders affect the performance of a signal. The number of candles used for each signal from the future is defined here. The larger this window becomes, the more time will be given to stop loss and take profit to close a position. If neither stop nor take happens to the end of the window, the system closes the opened position and calculates the profit/loss of the position.

Maximum Allowed Number of Signals per Window: A signal might be triggered more than once in the forward-looking window. For example, if you set the length of the window to 100 and a second signal is fired 20 candles after another one, you will have two signals in the forward-looking window. This parameter sets the maximum number of signals that are taken into account in a window. In the case of having two signals with 20 candles between, if you set the maximum allowed number of signals per window to one, the effect of the second signal on the profit/loss of the first one is ignored but if you set this value to any number greater than one, the second signal will also be taken into account. If you want to let all signals affect the profit/loss in the window, set this parameter equal to the length of the forward-looking window.

Maximum Stop Loss: The maximum value tested as stop loss

Maximum Take Profit: The maximum value tested as take profit

Stop Loss Resolution: This analysis checks the performance of the strategy with different values of stop loss ranging from zero to maximum Stop Loss value. Stop Loss Resolution defines the size of intervals between two consecutive tested values. Smaller values mean higher resolutions, and thus, the range between zero and maximum stop loss is divided into more intervals.

Take Profit Resolution: This is the resolution with which the range of zero to Maximum Take Profit is divided into intervals. The process is essentially the same as that of stop loss.

Fee (%): Fee is the cost of trading. This will be deducted from the profit of each position that signals make. If a position is closed in loss, the fee of the position will be added to the loss.

Trading Side: To run the analysis, you need to declare whether the signal is being used for long or short trading.

Profit Report

Profit Report report is a heatmap that illustrates the profitability of the signal with different stop loss and take profit values during the analysis range.

.png)

Win Rate Report

This report illustrates the strategy's win rate for different stop loss and take profit intervals. The win rate is the total number of positions closed in profit divided by the total number of positions opened in the analysis range. Note that a greater win rate does not necessarily lead to more profit. To make this clear, imagine that a strategy opens only one position, and this position is closed in 2% profit. Another strategy opens five positions, two of which are closed in 1% loss, and each of the other three is closed in 5% profit. The win rate of the first strategy is 100%, and the win rate of the second strategy is 60%. The profit made by the first strategy is 2%, but the profit of the second strategy is 13%, which is considerably higher than the first one. .png)

Trade Based Analysis

This analysis uses the selected signal as the entry signal of trading and evaluates the performance of the signal when another user-selected signal is used as the exit signal. Like Rally Based Analysis, this analysis also evaluates the strategy performance in rallies. The inputs of this analysis are:

Target: The target used as the base of analysis; the more your entry and exit signals match the target, the higher the scores will be

Exit Signal: The signal used to close the positions the user-selected signal opens

Pivot Length: The size of the window used to find rallies in the price; the larger this window becomes, the larger the rallies will be

Trading Highlights

The Trading Highlights reports how the entry and exit signals performed in the analysis time period. This report includes the following scores:

Rallies Covered: Shows what percentage of the rallies in the analysis time period were caught by the entry and exit signals; the higher this score becomes, the more trading opportunities are caught.

Entry Signal Success Rate: Shows what percentage of the positions opened by the entry signal match the target

Exit Signal Coverage: Shows in what percentage of the rallies the exit signal is triggered; note that the exit signal might be triggered when the strategy has no open positions and this report includes such exit signals

Successful Entry with Exit: Shows what percentage of entries that match the target have an exit in the same rally

Exit Signal Success rate: Shows what percentage of the exit signals match the selected target

Perfect Trade Rate: Shows what percentage of the strategy trades match the target in both the entry and exit point