Tutorial 3: Run a Backtest

Backtesting is the process of using historical price data to evaluate a strategy. It helps traders and analysts to measure the performance of a strategy in terms of profitability and risk. Through backtesting, you can learn more about the specifications of a strategy and use this knowledge to improve it.

In this tutorial, you will learn how to use QuamtiX's backtracking engine to evaluate your strategies. Our backtesting engine is a highly integrated tool that allows you to run backtests on different financial markets including stock, cryptocurrency, and Forex. It offers various position and money management configurations to provide sufficient flexibility.

In this tutorial, we won't go into details but will focus on running backtests in the simplest way possible.

Backtest Configurations

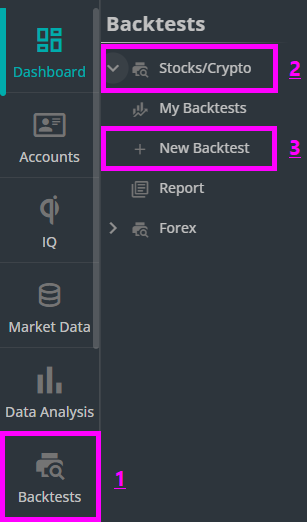

To run a backtest with the two defined signals, open the New Backtest from Stocks/Crypto section of the Backtests menu.

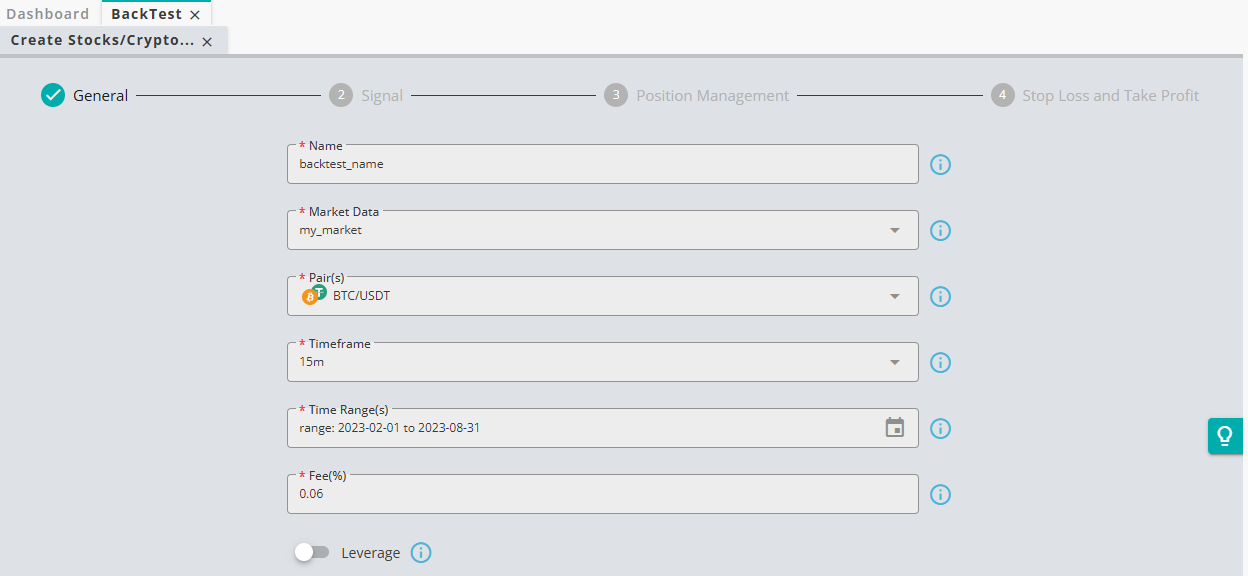

Every backtest consists of four main parts:

General

Signal

Position Management

Stop Loss and Take Profit

General

This page configures general parameters of the backtest. Enter a name for the backtest in Name box and select the market data where the signals are located. Choose as many pairs as you want from Pair(s) dropdown box. The backtest will be run for each asset separately. You can use group pairs to select pairs in bulk. To read more about these options, read "Backtest Documentation".

Once the pairs are selected, use Timeframe to set the backtest timeframe. From Time Range(s) select as many time ranges as you want. If you select multiple time ranges, one backtest will be run per each. Note that only time ranges within the available market data range are supported.

You can also set a trading fee to simulate the brokers or exchanges commissions. Keep in mind that fees vary depending on the broker or exchange you want to simulate. The Leverage option allows you to apply leverage to your trades. In this tutorial, we will not use leverage, so you should leave it off.

Signal

You can select your long and short entries and exits here. The system enables long trades by default, but if you want to make short trades, you can turn Short Trade on. Note that our backtesting engine supports making long and short trades simultaneously. To keep things simple, we only use long trade here.

Click on Long Entry and select your buy signal (ma cross buy). Click on Long Exit and select your sell signal(ma cross sell). Once your signals are selected, click Continue to proceed.

Position Management

Position management has two main modules, Position Management and Pyramiding Settings.

When a signal contains many sub-signals, Entry Threshold and Exit Threshold allows users to define the minimum number of sub-signals that must be true for the signal to initiate an entry or an exit. To learn more about these thresholds, refer to the "backtest documentation".

Enabling Conditional Thresholds allows you to change the threshold with respect to other signals. Since our buy and sell signals are simple and do not contain sub-signals, set the thresholds to one.

Pyramiding enables you to add steps to mitigate the risk of trading. To learn more about pyramiding, refer to the backtest documentation. However, we will not use pyramiding in this tutorial, so leave it turned off.

Stop Loss and Take Profit

As the name implies, this section allows you to use stop-loss and take-profit orders. Our backtesting engine supports both normal and dynamic stop-loss/take-profit orders.

• In normal mode, the stop-loss or the take-profit is a fixed value.

• In dynamic mode, users can adjust the stop-loss or take-profit based on other signals.

Use positive values for both stop-loss and take-profit percentages. To learn more about dynamic stop-loss/take-profit orders, refer to the backtest documentation.

For this tutorial, we will not use stop-loss or take-profit orders to observe how the strategy performs on its own.

Once you have finished configuring your stop-loss and take-profit settings, click Get Backtest. Your backtest will be directed to a page where you can track its progress. Wait for the progress bar to fill.

Congratulations! You have just run a backtest on our platform!